MCA Update: File Particulars or Get Penalised

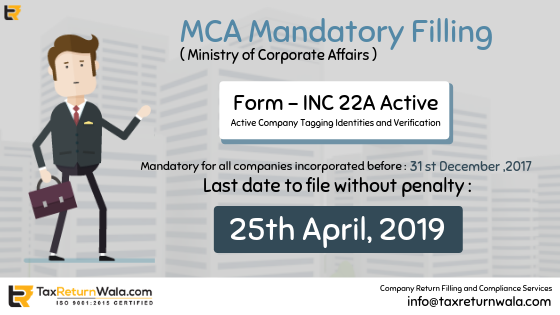

To pull up the reporting standards, the Ministry of Corporate Affairs has put forward a compliance notification for all companies incorporated before 31st December 2017 to electronically file their company particulars to the department before 25th April 2019.

Adding a strict dialog to the notification, MCA stated that the companies will now have to mandatorily file an e-form- INC 22A ACTIVE (Active Company Tagging Identities and Verification) to submit particulars of their business and its composition to the ministry officials.

The notification has been made with reference to the Company (Incorporation) Amendment Rules,2019 (being effective from 25th February 2019).

The companies have been called out to file the e-form INC-22A Active, once they

– have completed their filling of Financial Statements and Annual Returns.

– have checked DINs of all directors of the company to be in ‘Approved status’ and have not been de-activated or disqualified for non-filing of DIR-3 KYC u/s 164(2).

(Note: If in any case the Company Annual filing has not been done due to some internal disputes and is already reported to ROC, Companies can still e-file the form INC-22A Active ).

What is required to e-file Form INC-22A Active?

Filling of form INC 22A by companies requires detailed submission of :

- Name, address, photographs, location points of the Registered Office.

- Details of directors with Director Identification Number and DIN Status.

- Details of the appointed statutory auditor/auditor firm including Name, PAN, Membership Number, the duration for which the auditor/auditor firm has been appointed

- Details of Cost auditor appointed if any including- Name and number of Cost Auditors/Cost Auditor Firm appointed, member number, financial year to be covered by the cost auditors etc.

- Appointment details of CEO/Managing director/Whole time director if any or appointed for any other roles

- Details of the Company Secretary /CS Firm associated.

- SRN of AOC-4/AOC-4 XBRL and MGT-7 returns filed for FY 2017-18

Is there any exemption?

The reporting requirement of e-form 22A Active has been withdrawn by MCA from certain companies if they are found listed under :

- Companies whose name has been struck from the list of companies either by ROC or Suo Moto.

- Companies who are under the process of strike off.

- Companies under the process of amalgamation.

- Companies already dissolved.

What could be the consequences for non-filling or delayed filling of Form INC 22A Active?

MCA has defined compulsion for all companies satisfying the above criteria to file e-form INC 22A Active before 25th April 2019 else :

– For non-filling before the due date, the company shall have to pay Rs 10,000 as a penalty from 26th April 2019.

– The status of the company in MCA statutory data shall change to ‘Active-Non Compliant ‘.

– The company shall then be restricted from filling :

- E-form SH-7 ( Application for Change in Authorized Capital)

- PAS-3 ( Application for change in paid-up capital)

- DIR-12 (Application for change in Director except for cessation)

- INC-22(Application for change in Registered Office)

- INC-28(Filing of the court order with Ministry.)

– Company shall have to face direct action from ROC under Section 12(9) of the Companies Act,2013.

Note: Filling of Form INC-22A Active is mandatory before 25th April 2019.

Need assistance in filling form INC 22A?

Let your queries reach our support team at info@taxreturnwala.com