Circular Trading under Goods & Services Tax Act, 2017 (“GST”)

The term links to the share market for most of us. Practicing circular trading in shares, people tend to increase share price by planning a definite way of trading shares between a few people or companies involved. When these shares start booking profit, the people intending to invest in the company exits from the transaction leaving other newly engaged investors unaware of the actual situation.

To break the myth, that Circular trading is not only limited to the share market, but it is also important to get the term well explained that how it links to trading businesses and can influence some tax provisions as well.

#1 Circular trading in Business

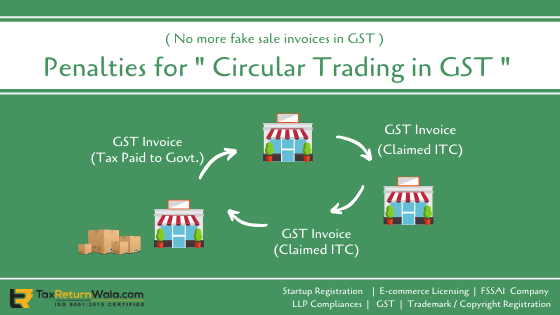

In simple terms, Circular trading in business includes transactions of issuing fake sales invoices without the actual supply of goods or services.

The intent to do the same is to avail input tax credits without making actual sales and reporting fake transactions in financials made with the collusion of two or more parties of business agreed on such trading.

Impact of circular trading on Businesses

With Circular trading, businesses involved become capable of inflating their financial reports, thereby helping them to raise easy loans and receive input credit on their transactions under GST.

#2 Circular Trading in GST

The GST provisions do not indicate in clear for unethical practices of business but it does provide the consequences to be faced by the defaulting entity or the person for getting involved in such practices.

Circular trading in GST can be better understood with the below situation:

SS Ltd sells goods to BB Ltd with the only the issue of an Invoice of Rs 72,000 and GST applicable Rs 12,960 (at 18%) without any actual movement of goods. BB Ltd further sold the same goods to DD Ltd and issued an invoice for Rs 60,000 including GST Rs 10,800 (at 18%) without any further movement of goods.

DD Ltd further issued the invoice to SS Ltd of the same goods for Rs 45,000 including GST Rs 8,100 (at 18%) again without movement of any goods. When making payment for tax by all three parties, claims for the ITC amount can be raised in the following manner:

| Sellers | ITC Claimed |

| 1) BB Ltd | 12960 – 10800 = 2,160 |

| 2) DD Ltd | 10800 – 8100 = 2,700 |

| 3) SS Ltd | 8100 – 12960 = (4,860 ) |

Here for inflating sales volume in books, SS Ltd paid Rs 4860 to the government which was claimed by other parties involved in circular trading.

#3 Regulations / Penalties against Circular Trading under the GST regime.

For all activities or actions made against or with the intention of non-compliance with GST provisions, the Central Goods and Service Tax Act, 2017 places very harsh regulations. In the case of circular trading, the tax authorities are even given ample freedom to arrest and detain any person or entity, without the issue of any warrant.

While Section 74 of the CGST Act, 2017, does provide intervening provisions for the proper officer to keep a check over entities availing Input Tax Credit in GST. Other than this the Section 32(1)(b) & and Section 132(1) of the Act brings the ambit of punishments for Circular Trading in GST.

The proper officer in the belief of any intentional motive of tax evasion can serve a show-cause notice to any person and call him to explain the officer for doubts raised in transactions.

For an issue of supply invoice without actual movement of goods or for availing of Input Tax Credit (ITC) without supply, the person involved shall be:

- Charged with a penalty fee which will be decided by the tax department based on the act committed by the taxpayer along with imprisonment for a maximum period of 5 years in case the tax amount evaded exceeds Rs 5 crore.

- Charged with, imprisonment for 1 year extending up to 3 years along with a penalty fee in case the tax amount evaded is within Rs 5 crore

No more liable to pay GST?

Consult our GST expert online at info@taxreturnwala.com

Also Read Conversion of Partnership to Company – Procedure, Rules & Tax Effect.